What is swing trading? How to select stocks for swing trading?

June 02

For swing traders, choosing the right stocks is a key factor in determining your success. This is not the same as long-term investing, where investors can “hold” stocks for months or years. On the contrary, Swing Traders need to look for stocks that have the potential to fluctuate in a short time frame, usually only a few days to a few weeks. This requires traders to not only understand the techniques but also know how to screen, evaluate and determine which stocks are worth investing in.

In the article below, CPT Markets will guide you specifically about swing trading and how to choose stocks when you want to be a successful trader in this style.

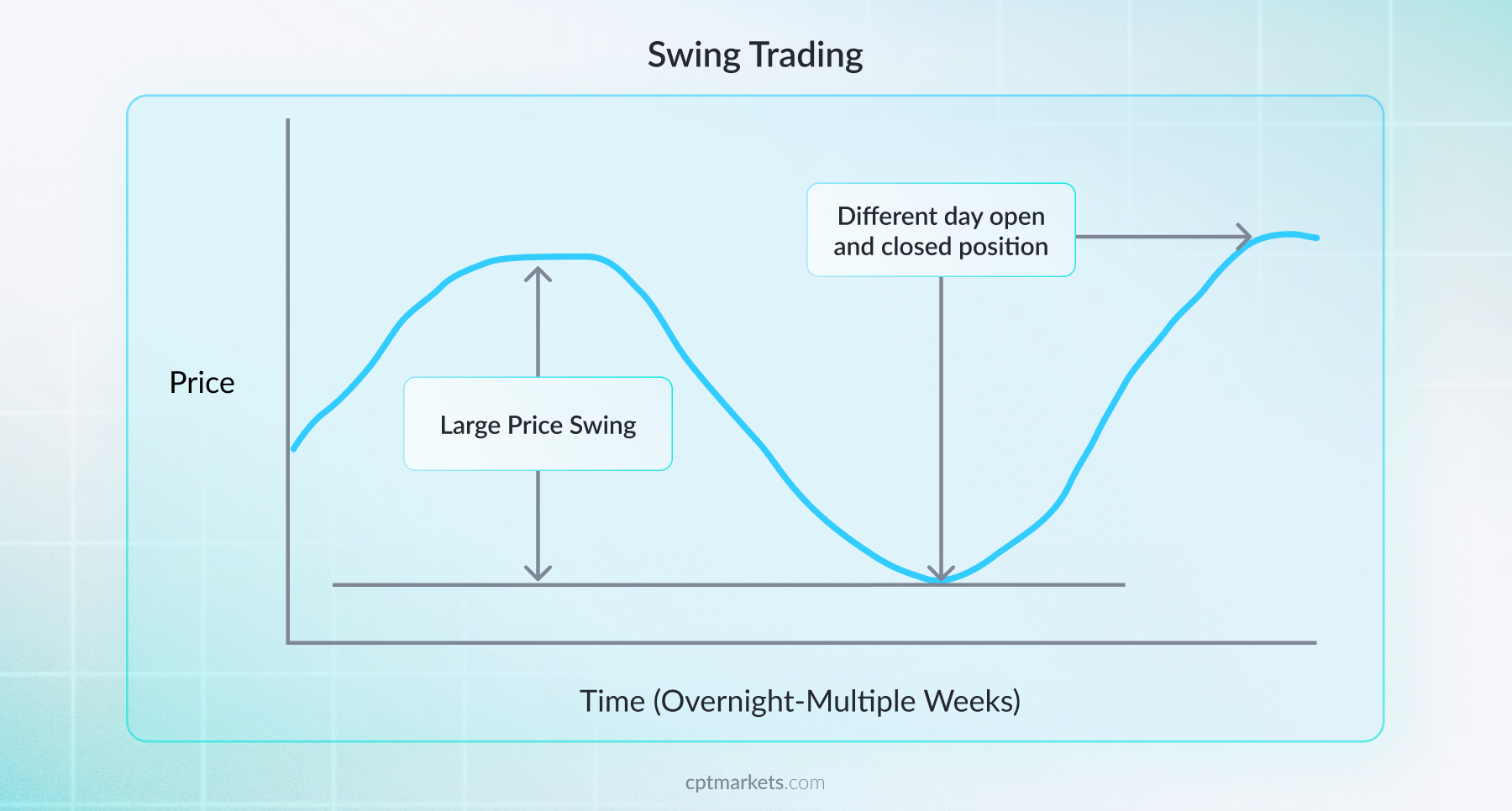

1. What is swing trading?

Swing trading is a short-term trading style. Trading orders will be held for a period of several days to several weeks in an effort to capture short-term market movements.

The goal of Swing trading is to capture opportunities to profit from price movements. In other words, Swing trading is determining market entry and exit points based on technical analysis and price action to trade profitably.

This is also the difference between Swing trading and Day trading and Scalping (only need to use technical analysis tools).

Swing trading takes place over a period of several days to several weeks, so traders do not necessarily have to monitor it continuously. Swing Trading not only brings flexibility in time but also helps traders take advantage of the clear ups and downs of the market. This is a suitable choice for those who want to balance between their main job and trading activities..

2. Characteristics of Swing trading

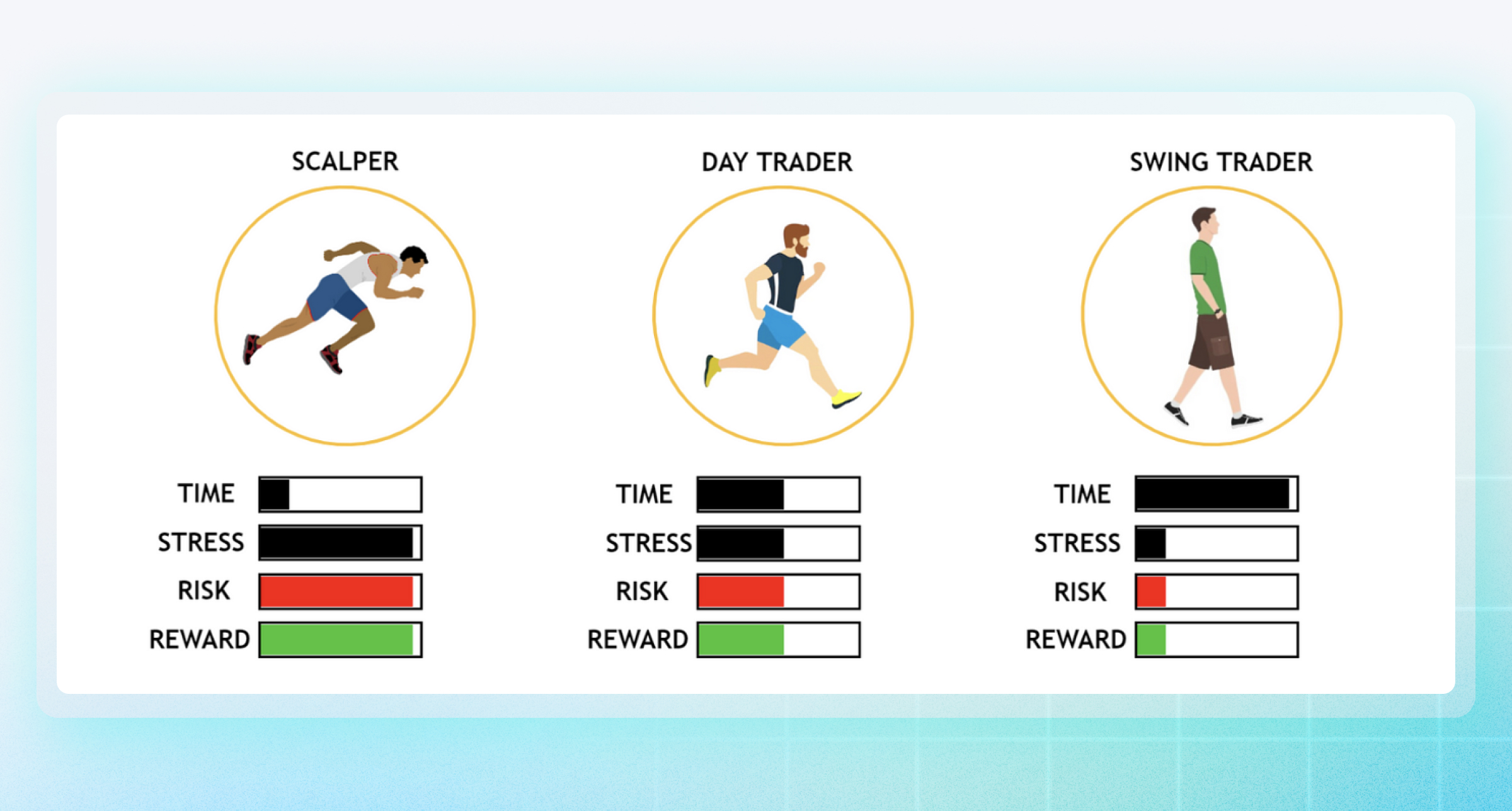

Compared to Day Trading and Scalping, Swing Trading has a lower trading frequency, which helps reduce psychological pressure and trading costs significantly. The expected profit level with this method is usually around 12%, while the risk is controlled below the threshold of 3% for each trade.

Because the holding period lasts from a few days to a few weeks, Swing Traders do not need to monitor the market continuously. This not only saves time but also reduces stress, something that even experienced traders find difficult to practice when it comes to trading psychology. Therefore, swing trading is very suitable for those who cannot devote all their time to investing.

3. Advantages and disadvantages of Swing trading

From the characteristics mentioned above, we can see that Swing trading has the following advantages and risks:

Advantages of Swing trading:

- Due to less trading frequency, longer position holding time compared to Day trading and Scalping and traders do not need to continuously observe the market, reducing the pressure on trading

- Reduced trading costs due to fewer orders

- Better trading signals due to the use of technical analysis, fundamental analysis and analysis on large time frames

- High profits due to catching big waves

- Save time due to no need to continuously monitor market fluctuations

- Reduce the risk of market traps because large trading time frames avoid market manipulation

- Have enough time to analyze and adjust trading orders according to market conditions.

Disadvantages of Swing trading:

- Profit taking time is quite slow due to the lack of big market waves

- Easily affected by major economic and political news

- Must pay overnight fees (swap fees).

- Need to have foresight and patience to avoid being affected by small market fluctuations

From these advantages and disadvantages, we can see that Swing trading is a suitable method for traders who have strategic thinking and prefer a balance between time and trading efficiency.

While Swing trading does not require constant market monitoring like other short-term methods, it still requires discipline, analytical ability and patience to optimize profits during medium-term market fluctuations.

4. Who is Swing trading suitable for?

Who is Swing Trading suitable for? Perhaps many people are wondering who this type of trading is suitable for. And whether they can use it or not?

Based on the characteristics of Swing Trading, we can see that this type of trading is suitable for: Experienced traders and part-time traders.

Firstly, Swing is a trading method that requires both technical analysis and fundamental analysis. These techniques require traders to have a certain amount of knowledge and experience to be able to make the most accurate judgment.

Next, this trade does not require the order taker to constantly monitor market fluctuations, so it is suitable for part-time traders or those with little time.

Finally, Swing trading is also suitable for people with patience, discipline and good emotional control. Since orders are held for several days to several weeks, traders need to avoid being affected by small fluctuations during the day and stick to the original strategy.

5. Swing Trading Strategies For Stock Trading

To trade Swing effectively, traders need to flexibly combine technical analysis tools to determine optimal entry and exit points.

Among them, three methods are commonly used and highly effective: trading with support - resistance zones, trading according to price channels and trading according to price models. Each method has its own approach, suitable for different market contexts, helping traders take advantage of short-term fluctuations to earn profits:

Trading with support and resistance:

Support and resistance are popular technical analysis tools that can be applied to most trading strategies - and Swing trading is no exception. When using these two important price zones, traders can apply two popular strategies:

- Breakout Strategy: When the price breaks through a strong support or resistance zone, it often continues to move in the direction it just broke. Swing traders can take advantage of this opportunity by entering a Buy order when the price breaks out of the resistance zone, or entering a Sell order when the price breaks below the support zone.

- Pullback Strategy: When the price returns to a support or resistance zone after a move, this can be a good time to enter an order in the direction of the main trend. Enter a Buy order when the price pulls back to support and shows signs of bouncing; enter a Sell order when the price touches resistance again and reverses down.

Trading with price channels:

Price channel is a tool that helps traders determine the short-term market oscillation zone. With this method, traders take advantage of oscillation waves in the channel to enter orders:

- Place a Sell order when the price moves to the upper boundary of the channel.

- Place a Buy order when the price touches the lower boundary of the channel and shows signs of bouncing back.

This method works well in sideways or slightly trending markets.

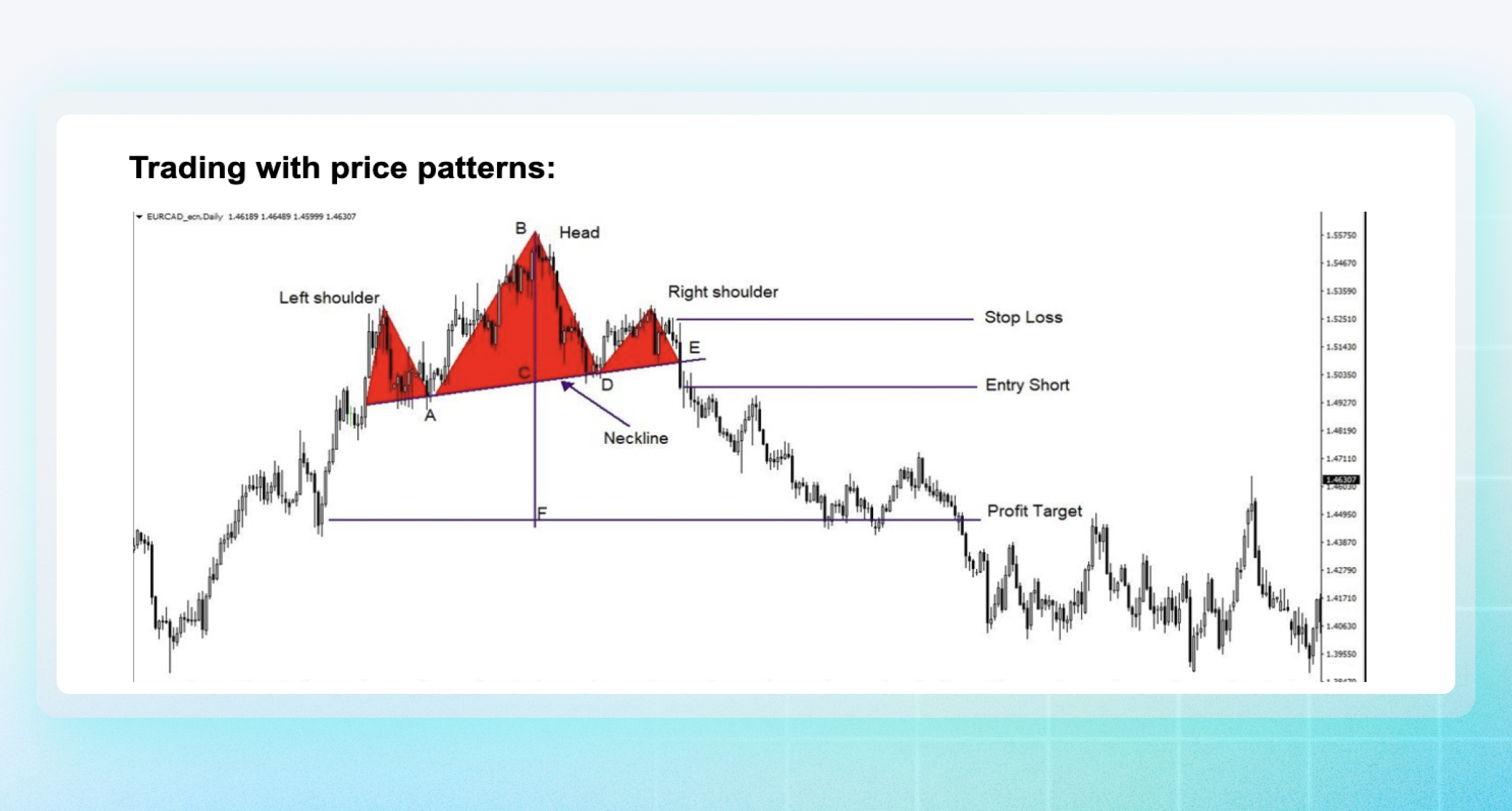

Trading with price patterns:

Price patterns are important tools that help traders identify market behavior and predict the next price direction. When trading according to patterns, traders need to carefully observe the chart to accurately determine the shape of the pattern, thereby planning to enter orders, take profits or cut losses appropriately. There are two main groups of patterns:

- Continuation patterns: Indicate that the current trend will continue, such as triangles, pennants, etc.

- Reversal patterns: Indicate that the current trend may end and reverse, such as head and shoulders, double tops and double bottoms, etc.

6. Commonly Used Indicators For Swing Trading

Below are some popular and useful indicators that Swing traders often apply:

- Moving Average (MA): Moving averages, especially long-term moving averages, are powerful tools in Swing Trading. When combined with other indicators, MA helps traders identify trend reversals, thereby detecting potential opportunities. It also helps to better understand the strength of the current trend, supporting timely buying or selling decisions.

- Relative Strength Index (RSI): RSI is a great tool for identifying swing trading opportunities, especially in the medium term. When RSI is above 70, the market may be overbought and could fall. Conversely, when RSI is below 30, this could indicate that the market is oversold and could rise.

- MACD (Moving Average Convergence Divergence) indicator: MACD is a momentum indicator that helps identify changes in trend direction and can give strong buy or sell signals. When the MACD line crosses above the signal line, this is a sign of a strong uptrend, while when the MACD line crosses below the signal line, this is a bearish signal.

- Bollinger Bands: Bollinger Bands provide a simple way to gauge market volatility. When prices approach or cross the upper or lower bands, it can indicate a trend reversal or continuation, helping traders find buying or selling opportunities when the market is overbought or oversold.

These indicators, when combined together, will help you have a clearer view of the market trend and volatility, thereby making accurate trading decisions.

7. Summary of how to build a specific Swing trading strategy

To trade Swing effectively, you need a clear strategy and a consistent process. Building a strategy not only helps you control your emotions when trading but also helps increase the probability of success. Below are 6 specific steps you can refer to:

Step 1: Analyze the overall market - Take the time to assess the general trend of the market, determine whether the market is in an uptrend, downtrend or sideways. This helps you choose the right trading direction.

Step 2: Identify the value area - Look for strong support/resistance zones, supply-demand zones, confluence zones between technical indicators. These are potential places to set up trades.

Step 3: Find trading signals - When the price moves to the defined value zone, wait for confirmation signals such as reversal candlestick patterns, signals from technical indicators or price action.

Step 4: Set up a trade - Determine the exact entry point, along with a stop-loss to limit risk and a take-profit to ensure expected profit.

Step 5: Risk Management - Only risk a small portion of your capital per trade (usually 1-3%). Don't go all-in or let emotions dictate your decision making.

Step 6: Monitor and adjust the trade if necessary - Monitor the market movements according to the selected time frame. You can adjust the stop loss or take profit if the market moves strongly as expected.

8. How to choose stocks for Swing Trading

Swing Trading not only requires technical analysis skills, but also depends on choosing the right stocks. Not every stock is suitable for Swing Trading - it is important to choose stocks with enough liquidity, reasonable price fluctuations and clear signals. Below is a system of criteria and effective stock selection processes that you can apply, especially in the US stock market.

Criteria for selecting Swing Trading stocks:

I. High liquidity.

Choose stocks with an average daily trading volume of more than 1 million shares. This will help:

- Easy entry/exit

- Reduced slippage risk

- Sufficient “market depth” for more accurate technical analysis

For example: Apple (AAPL), Tesla (TSLA), Nvidia (NVDA) regularly trade over 10 million shares/day and are well suited for Swing Trading.

II. Reasonable price fluctuations.

Good stocks for Swing Trading should have a moderate daily fluctuation level (Average True Range - ATR):

- Too low: Not enough profit margin

- Too high: High risk, difficult to control

You should look for stocks with an ATR in the 2%-5% range of the stock price, or check the history of regular swings

For example: AMD often fluctuates within the 4-6%/session range when there is chip industry news, which is also an ideal opportunity to Swing.

III. Clear trend:

Prioritize the following stocks:

- In a stable uptrend (higher highs, higher lows) and vice versa in a downtrend (lower highs, lower lows)

- Just exited a long-term accumulation zone

- Breaking out of a price channel or major resistance

- On the contrary, avoid stocks that move sideways with no clear trend or fluctuate erratically.

IV. Clear technical signals

Good stocks usually have:

- Clear reaction at support/resistance zones

- Complete price pattern (Cup and handle, Bull Flag, Inverse Head and Shoulders…)

- Confirmation signals from RSI, MACD, MA, Bollinger Bands,…

For example: If MSFT just Breakout the $410 resistance zone with high volume, RSI at 60-65, this is a signal Swing Traders can consider buying.

V. Has Supporting Fundamental Factors

Although Swing Trading mainly uses technical analysis, stocks with good fundamentals will be less risky, especially in the 3-10 day holding period.

Therefore, you should prioritize stocks with the following factors:

- Stock has just announced a good financial report (strong EPS growth)

- Benefiting from industry trends: AI, electric vehicles, clean energy...

- No scandals, legal investigations or internal crises

9. Notes when Swing trading and tips to make Swing trading more effective

To trade Swing effectively and limit risks, traders need to note the following important points:

- Don't trade emotionally: Making decisions based on emotions can easily lead to mistakes, especially when the market is volatile.

- Don't ignore the fundamentals: Economic and political news can have a big impact on the market for days or weeks - exactly the same as the Swing trader's holding period.

- Manage orders during off-hours: Since Swing trading lasts overnight or on weekends, consider the possibility of slippage or gaps.

- Accept losses: Not every trade is a winner. Being disciplined and accepting losses is a prerequisite for survival and growth.

Some CPT Tips for Swing Trading More Effectively:

- Combine multiple time frames: Observe the overall trend on a large time frame (daily/weekly) and determine the entry point on a smaller time frame (H4/H1) to optimize the entry point.

- Use a trading diary: Record trading orders to gain experience, identify strengths and weaknesses in the strategy.

- Always update knowledge: The market is constantly changing, learning and improving skills is necessary.

- Optimize the R:R ratio (Risk: Reward): Ensure that the expected profit is always higher than the risk (for example, the R:R ratio is 1:2 or 1:3).

- Be patient and disciplined: Swing trading is not suitable for impatient people. Success comes from perseverance and strict adherence to the established process.

10. Summary

Swing trading is a short-term trading style that does not require you to be glued to the screen all day. It combines flexibility and good profitability if applied correctly.

Through this article, CPT Markets hopes that you have grasped the concepts, characteristics, strategies, tools as well as the necessary notes to start with Swing trading.

At CPT Markets, we currently offer over 2,000 trading instruments with a diverse portfolio spanning markets such as stocks,forex , indices, cryptocurrencies and commodities.

With an advanced, transparent technology platform and an international standard trading environment, CPT Markets promises to be a solid broker, accompanying you on your trading journey in the global financial market.

Recent Articles

Frequently Asked Questions

Swing Trading is a short & medium term trading strategy where positions are held for several days to several weeks to take advantage of obvious “price waves”. Compared to Day Trading or Scalping, Swing Trading is less stressful and suitable for busy people who cannot monitor the market continuously.

At CPT Markets, you can trade stocks, indices, forex, cryptocurrencies… according to Swing strategy with real-time charts, advanced analysis tools or experience a free demo account to practice before investing real capital.

Swing Trading does not require a large amount of capital. With leverage up to 1:20 when trading CFD stocks at CPT Markets, you can open positions many times larger than your real capital. For example, with just $200, you can access a US stock portfolio worth $2,000 - $4,000.

Yes. On CPT Markets MT4/MT5 platform, you can:

- - Add your favorite indicators like RSI, MACD, MA, Bollinger Bands.

- - Multi-timeframe observation (H1, H4, Daily, Weekly,…)

- - Use multiple available drawing tools

- - Customize interface, set technical alerts

- - Integrate Scripts and custom-designed indicators.

And there are many other technical analysis support functions waiting for you to discover.

You can get started in 3 simple steps:

1. Register a CPT Markets account (takes only 10 minutes)

2. Start a demo account and try Swing strategies with real market data

3. Deposit from $100 and apply the steps learned to a real account with controlled risk

We also regularly organize online workshops on Swing strategies – you can register directly on the website.

At CPT Markets, you can apply Swing Trading to: US, UK, EU, Hong Kong stocks. Forex market (EUR/USD, GBP/USD, USD/JPY…). Crypto market (Bitcoin, Ethereum, Litecoin…) and Commodity market, indices such as WTI, Gold, NASDAQ, S&P 500.

We provide over 2,000 trading instruments with live data, making it easy for you to apply your Swing strategy.